Select a question type

-

Buying a home can feel overwhelming. Brevis makes the process clear and guides you every step of the way.

- Work out how much you can afford and how much you will need for a deposit.

- Apply for a mortgage in principal from your chosen lender, which confirms they are willing to lend you an agreed amount for a property..

- Start to view properties in person and get to know the best areas for you to live.

- Find ‘the one’ and make an offer to the estate agent. Mentioning you’re a first time buyer if you are one could be an advantage.

- Offer accepted! Apply for a mortgage from your lender and find a solicitor or conveyancer to help you with the legal process.

- Get a survey. Most surveyors provide 3 levels of survey – a condition report, a HomeBuyers report and a building survey. Choose the right one for you.

- Your conveyancer will arrange searches, which can include local authority, environmental and water searches, to help avoid any potential issues.

- Swap your contracts with the home seller (exchange), transfer money and collect your keys (complete) – Congratulations! You’ve bought your new home!

-

It is not uncommon for property transactions to take 10-12 weeks, but delays can occur. We believe in transparency, meaning that our account managers will keep you informed throughout your house selling process.

- Get a rough idea of how much your property is worth. Don’t forget when calculating your costs to check with your lender if there are any fees for early repayment costs payable on your existing mortgage. You may also need to confirm if it can be moved to your new home.

- Choose an estate agent to sell your property and agree on fees.

- Ensure you have standardised documents for your property, including an energy performance certificate (EPC).

- Decide on how much to sell your property for.

- Start getting your home ready for sale. The more ‘staged’ it looks, the more likely you are to sell.

- Get a conveyancer to handle the legal side of selling your property. It’s best to decide on the conveyancing firm before you agree on the sale – you just can’t formally work with them until an offer is agreed.

- Fill out property questionnaires provided by your conveyancer. This will help ensure everything is clear to both parties during the sale.

- Your conveyancers will now work on your behalf to get everything ready for exchanging contracts with your buyers. The next and final stage is then completion – when you’ve fully sold your property and can hand over the keys!

-

Owning a freehold property means that you own the whole of that property, including the land it’s associated with and rights that come with it, such as parking access. You own these rights for an unlimited amount of time. You’re free to do what you want with your home (subject to planning regulations).

On the other hand, a leasehold property means that you only own the property itself, not the land it’s built on. This is owned by the landlord. Leasehold also means that you only own the house for a certain amount of time, such as 99 years, and there will likely be restrictions as to what you can do.

-

The conveyancing process usually starts when you’ve made an offer on a house when buying, or accepted an offer on your home when selling. But you can actually choose your conveyancer before this. This helps ensure the initial paperwork is underway as soon as possible, and means you can hit the ground running when offers are accepted. Typically, conveyancing takes 12-16 weeks, but there can be delays. Our aim is to speed the process up wherever we can, so you can get moving quickly. If, for any reason, issues do arise during your sale or purchase, we’ll keep you updated every step of the way, so you stay informed and we work to make your move as stress-free possible.

-

Disbursements: payments we make on your behalf to third parties e.g. stamp duty or for property searches.

Stamp Duty: a tax you pay when purchasing a property; first time buyers are exempt up to £300,000. See here for a calculator on how much you’ll need to pay for your dream home.

Searches: a collection of reports about the land surrounding your new home.

Freehold: you own the building and the land in perpetuity.

Leasehold: you own the property for the length of your lease agreement, you’ll usually pay maintenance fees and annual ground rent.

Peppercorn rent: a token or nominal rent, fairly common on very long leaseholds, can be as small as £1 per annum.

Exchange: solicitors exchange contracts and your moving in date gets arranged.

Completion: you now officially own your new home!

Gazump: a seller reneges on your offer and accepts a higher offer from another buyer.

Chain: a group of buyers and sellers connected in a property chain.

Homebuyers report: a report giving an overall opinion on the condition of a property that helps you decide whether or not to go ahead with the purchase.

Royal Institute of Chartered Surveyors (RICS): RIC surveyors conduct homebuyers reports.

-

Mortgage in principle: a document from your lender indicating how much they will lend in order for you to purchase a property, it’s not a full loan agreement at this stage.

Mortgage valuation: an assessment undertaken by the mortgage lender to confirm a property’s value.

Mortgage broker: a person or company that arranges a mortgage between you (the borrower) and a mortgage lender.

Standard variable rate (SVR): an interest rate set by your lender. It is usually based on the Bank of England base rate and so can go up or down.

Early repayment charges (ERC): a fee payable to your mortgage lender for overpayment or leaving your deal early.

Fixed rate mortgage: means your interest rate is guaranteed for a fixed period, usually between 2 and 10 years, so your monthly repayments stay the same.

Interest only mortgage: each month you pay the interest owing, but nothing towards the loan itself. At the end of the period you owe the remaining balance in full.

Tracker mortgage: works on a variable rate by ‘tracking’ a base rate, set by the Bank of England. Your repayments may go up or down depending on current interest rates.

-

Sold subject to contract (SSTC): when an offer is accepted, a listing site will update the property to SSTC until completion.

Subject to planning permission (STPP): a property with potential to renovate or convert may have this tag included on its page.

-

Buying a home can feel overwhelming. Brevis makes the process clear and guides you every step of the way.

- Work out how much you can afford and how much you will need for a deposit.

- Apply for a mortgage in principal from your chosen lender, which confirms they are willing to lend you an agreed amount for a property..

- Start to view properties in person and get to know the best areas for you to live.

- Find ‘the one’ and make an offer to the estate agent. Mentioning you’re a first time buyer if you are one could be an advantage.

- Offer accepted! Apply for a mortgage from your lender and find a solicitor or conveyancer to help you with the legal process.

- Get a survey. Most surveyors provide 3 levels of survey – a condition report, a HomeBuyers report and a building survey. Choose the right one for you.

- Your conveyancer will arrange searches, which can include local authority, environmental and water searches, to help avoid any potential issues.

- Swap your contracts with the home seller (exchange), transfer money and collect your keys (complete) – Congratulations! You’ve bought your new home!

-

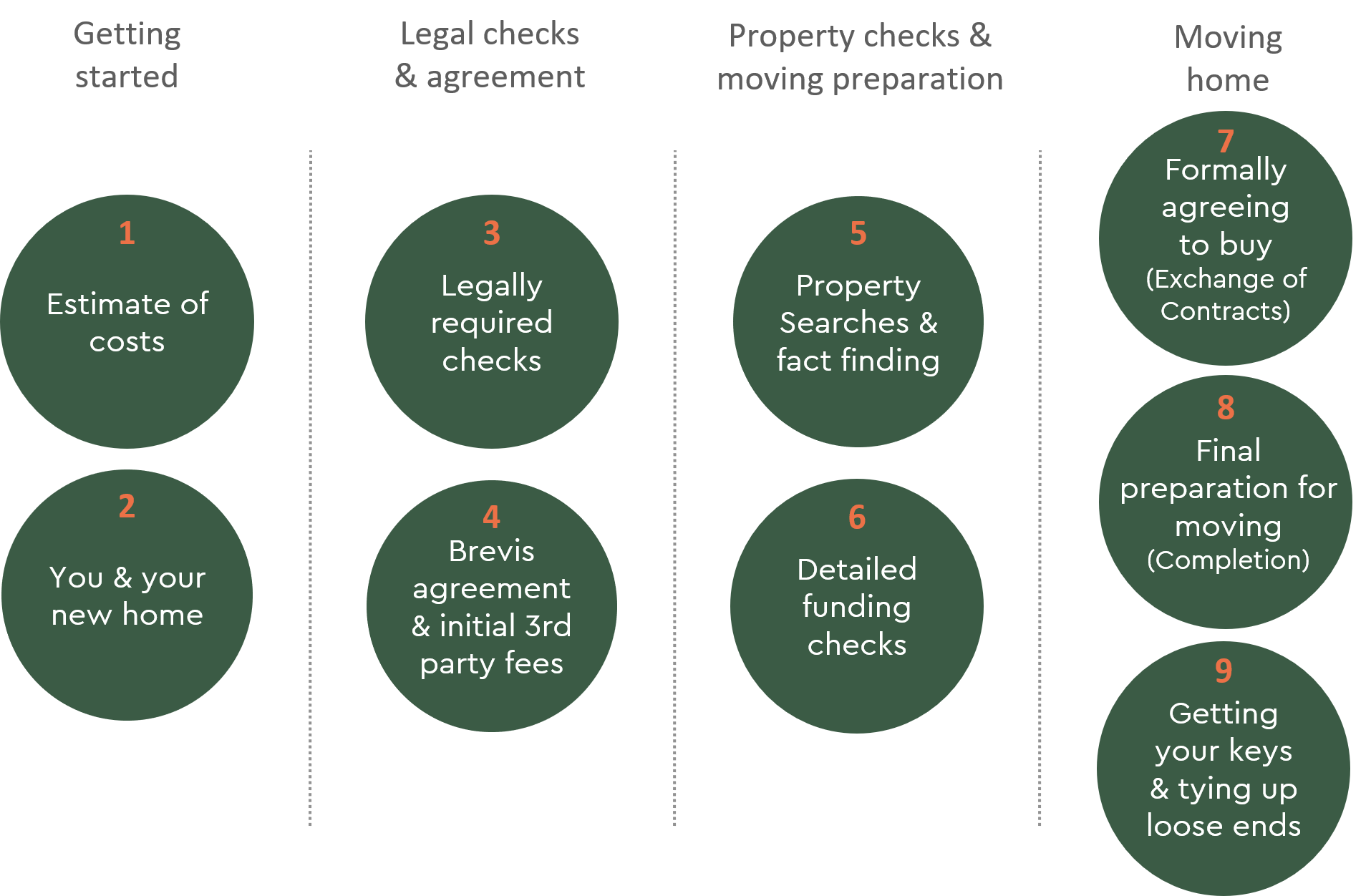

We break down the stages of the process into milestones so our clients can keep track. Within each milestone there are tasks for either you to complete or for Brevis to complete. We can also be actively working on more than milestone at a time as we progress through.

-

It is not uncommon for property transactions to take just a few months, but delays can occur. We believe in transparency, meaning that our account managers will keep you informed throughout your house selling process.

- Get a rough idea of how much your property is worth. Don’t forget when calculating your costs to check with your lender if there are any fees for early repayment costs payable on your existing mortgage. You may also need to confirm if it can be moved to your new home.

- Choose an estate agent to sell your property and agree on fees.

- Ensure you have standardised documents for your property, including an energy performance certificate (EPC).

- Decide on how much to sell your property for.

- Start getting your home ready for sale. The more ‘staged’ it looks, the more likely you are to sell.

- Get a conveyancer to handle the legal side of selling your property. It’s best to decide on the conveyancing firm before you agree on the sale – you just can’t formally work with them until an offer is agreed.

- Fill out property questionnaires provided by your conveyancer. This will help ensure everything is clear to both parties during the sale.

- Your conveyancers will now work on your behalf to get everything ready for exchanging contracts with your buyers. The next and final stage is then completion – when you’ve fully sold your property and can hand over the keys!