Select a question type

-

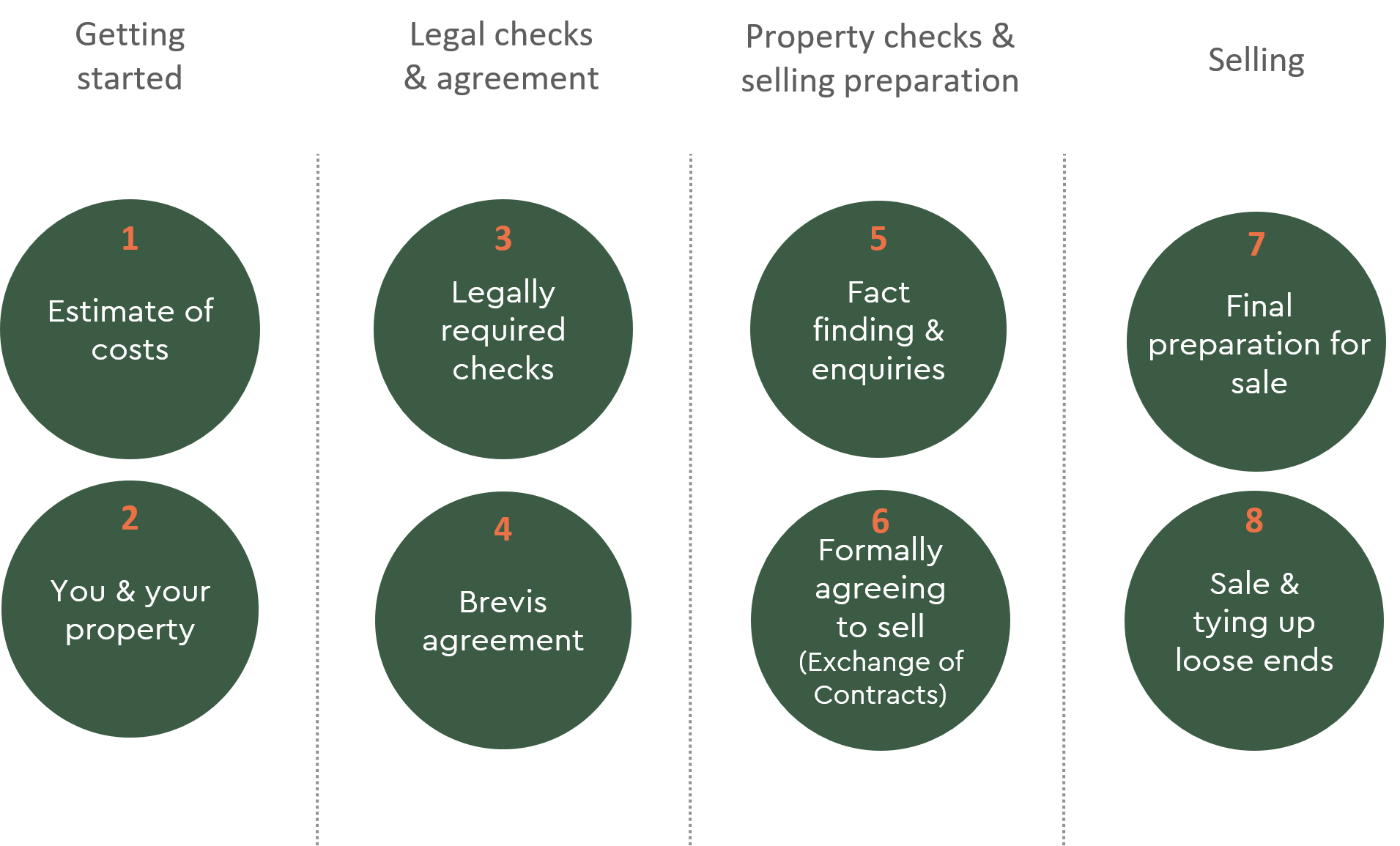

We break down the stages of the process into milestones so our clients can keep track. Within each milestone there are tasks for either you to complete or for Brevis to complete. We can also be actively working on more than milestone at a time as we progress through.

-

The conveyancing process usually starts when you’ve made an offer on a house when buying, or accepted an offer on your home when selling. But you can actually choose your conveyancer before this. This helps ensure the initial paperwork is underway as soon as possible, and means you can hit the ground running when offers are accepted. Typically, conveyancing takes 12-16 weeks, but there can be delays. Our aim is to speed the process up wherever we can, so you can get moving quickly. If, for any reason, issues do arise during your sale or purchase, we’ll keep you updated every step of the way, so you stay informed and we work to make your move as stress-free possible.

-

A Help to Buy ISA is a Government backed scheme aimed at boosting your savings toward buying your first home. If you put money into a Help to Buy ISA the Government will, when you use those savings to buy a home, top up your savings by adding a 25% bonus. The maximum government bonus you can receive is £3,000. The maximum amount you can save into the account is £200 each month.

-

If you do not already have a Help to Buy ISA account, then it is too late to open one as the scheme was closed to new accounts at midnight on 30 November 2019. If you have already opened a Help to Buy ISA, you will be able to continue saving into your account until November 2029.

-

The Government bonus is not automatically added to your Help To Buy ISA account. It is only paid when you use the savings to buy a qualifying home and is claimed during the conveyancing process. The solicitor acting for you will claim the bonus between exchange of contracts and completion of the purchase. The process takes time and will require action to be taken by you. It is important, therefore, that you tell your solicitor about your Help to Buy ISA as soon as the conveyancing process starts. If you do not and the strict deadlines imposed by the scheme are not met, you may lose the bonus.

-

The Help to Buy scheme offers a loan where the government lends first-time buyers money to buy a newbuild home. In return for the loan the Government will take a mortgage over your home. This mortgage will be based on the percentage of the purchase price you borrow from the Government. When you sell your home, you must repay the same percentage of the sale price as the initial equity loan. This means that if you take out an equity loan for 20% of the purchase price then you must repay 20% of the price at which you sell. If the value of your property has increased, the amount you have to pay back will likely be more than you originally borrowed.

There are certain criteria to be met in order to qualify to use the scheme.

-

To qualify for the Government Help To Buy scheme you must meet the following criteria:

- The purchase price must not exceed the maximum set for the area. These vary across the country, ranging from £186,100 to £600,000

- You must be a first-time buyer

- You must live in the property

- The maximum you can borrow is 20% of the purchase price (or 40% in London)

- You must be purchasing a new build property

- You must pay a minimum deposit of 5% from your own money

- You must take out a mortgage

-

The Help to Buy loan is interest free for the first 5 years but you are required to pay a £1 monthly management fee by Direct Debit. After the end of the interest free period, and until you repay the loan in full, you will be required to pay:

- The £1 monthly management fee

- Monthly interest at the rate of 1.75% per year of the equity loan amount

The interest payable will rise each year. The increase will be based on the Consumer Price Index (CPI) plus 2%. The payments due on the Help to Buy Loan are in addition to the payments you are required to make to your mortgage lender.

-

A Shared Ownership property is essentially a combination of buying and renting. You will own a share of the property and pay rent to a Housing Association on the part you don’t own. Shared ownership properties are always leasehold. This applies irrespective of whether the property is a house or a flat. The lease will contain restrictions which you will need to follow. The rent on the share you don’t own will be reviewed every year and will usually increase.

Some properties which are Shared Ownership can be located in what is known as a ‘designated protected area’ – These properties can only be bought by buyers who have a connection to the local area and in some cases you will only be able to purchase up to 80% of the property. When you come to sell, you may also be limited to selling back to the landlord, or another eligible person the landlord nominates.

Your Local Housing Association will be able to provide more detailed information or you can visit: www.gov.uk/affordable-home-ownership-schemes/shared-ownership-scheme

-

To qualify for Shared ownership the combined salary or other earnings of both you and your spouse or partner must not be more than £80,000 a year or £90,000 a year if you live in London. In addition, any of the following must apply:

- You are a first-time buyer

- You used to own a home, but cannot afford to buy one now; or

- You already own a Shared ownership property

In some cases, the property may also be located in a ‘designated protected area’ which may mean that to be eligible, you also have to have a connection to the local area. Properties of this kind are also often limited to a maximum of 80% ownership, or a requirement if you wish to sell, that you must sell back to the landlord, or another eligible buyer the landlord nominates, meaning you are not able to sell on the open market.

In all cases, you will be required to undertake an affordability assessment which will be carried out by an Independent Financial Advisor. They will assist you in assessing the share you are able to purchase and the affordability of mortgage and rent payments.